The biggest film of 2021 is here, and pandemic era box office records are poised to go down in a web of glory.

It’s no longer a question of if Spider-Man: No Way Home‘s debut will be impressive, but just how staggering it could end up as constant speculation throughout 2021 about when or if the year would see a $100 million-plus domestic weekend by a single film could potentially be put to rest as early as this Friday night.

The film’s global release is under way with various record earnings already reported out of the United Kingdom, France, Korea, Mexico, and others, suggesting a potential $375 million-plus global weekend bow is in play. The domestic market’s part in that will be crucial as the massively anticipated Marvel Cinematic Universe chapter unspools across 4,336 locations this weekend.

Sony itself noted an expectation of a $130 million domestic opening in their background email earlier this week. Clearly, though, box office forecasts span a wide array of numbers.

Our prior long range reports began conservatively (in retrospect) before ballooning to much higher projections after pre-sales soared beyond even optimistic expectations after Thanksgiving. Momentum has maintained in the weeks since, and very enthusiastic reviews (currently 95 percent on Rotten Tomatoes) are adding to the cacophony of optimism about what the film can do for the domestic and international box office markets.

In terms of pre-sales, Fandango on Thursday reported they’ve already sold more tickets for No Way Home than the entirety of any single film’s theatrical run in 2021. Important to note, though, is that those sales encapsulate all calendar availability. In other words, tickets counted extend well beyond the opening weekend and include weekdays leading up to Christmas with its proximity as many moviegoers plan ahead for their holiday week outings.

In a normal world, this would be a sure fire mega-blockbuster without a single “con” to report alongside the growing list of “pros”. Still, the pandemic remains a consideration. No Way Home is likely to bring back many moviegoers for the first time since pre-COVID, but recent concerns about the Omicron variant and renewed mask and/or vaccine mandates in major markets present the latest challenges of projecting what the film’s box office ceiling is.

The added news of Ontario limiting movie theater and other public venue seating capacities to 50 percent beginning this weekend adds to some uncertainties, although from a sheer numbers perspective, that’s likely to have little dent on Spider-Man‘s box office. Canada as a whole represents 10 percent of domestic box office on average, with Ontario itself accounting for an estimated 38 percent of Canadian population.

The news cycle itself is the biggest source of competition for not just Spider-Man but moviegoing as a whole, particularly in New York City right now. Consumer sentiment remains somewhat volatile, but younger audiences (this film’s bread and butter) have proven their eagerness to return to theaters this year while pandemic fatigue across a variety of demographics and geographic regions has settled in even despite new variants taking over media headlines.

Repeating what’s been said many times over the past two years, everything is fluid as caution and concerns surrounding the virus vary from person to person, community to community, and market to market.

Spidey By the Numbers

How have box office expectations for No Way Home‘s domestic evolved over time? It’s been a rollercoaster, but one without many sharp dives. The good news still far outweighs the bad, and momentum is in the film’s favor at this point — at the very least for opening weekend and going into Christmas week.

The important context to mind for this film is that there are no true data sets to compare with outside of pre-pandemic releases. The prior tentpoles to open in theaters this year saw wildly different trajectories over their respective pre-release windows, meaning No Way Home is in a category all its own when trying to gauge consumer sentiment and walk-up business potential in a late-stage pandemic world.

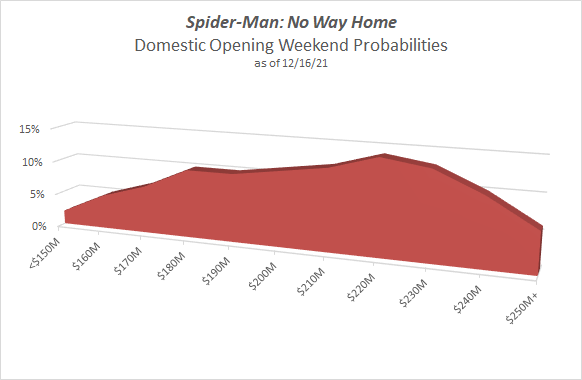

Since tickets went on sale, however, even pandemic-adjusted models had to begin accounting for a new shift in probabilities. For example, the chart below breaks down projected odds of target box office ranges using the most updated model with pandemic releases in mind — in tandem with adjusted patterns by pre-pandemic uber-performers.

Worth noting is that these target opening weekend ranges would be an estimated 10 to 20 percent higher using exclusively pre-pandemic models and simultaneously assuming the same pre-sale and social media data would be in play. The wait-and-see aspect here is to find out how accurately this particular model will have deflated projections for pandemic sentiment and consumer habits as they are today, which could heavily inform upcoming forecasts for 2022.

According to Showtimes Dashboard, theater owners are certainly planning for Spider-Man and the multiverse like they would have for a pre-pandemic event.

From the start of Thursday previews through Sunday’s end, the film is currently booked for over 200,000 domestic showtimes across a sample of 3,406 theaters as of early Thursday afternoon. That represents 46 percent of the market while pacing ahead of the final samples for Star Wars: The Rise of Skywalker (206,000 from 3,952) and Avengers: Infinity War (202,000 from 3,683).

The pandemic-best Dashboard metric previously belonged to Venom: Let There Be Carnage (148,000 from 3,532), a mark already far exceeded by No Way Home.

Social media buzz remains utterly dominant over all pandemic era releases, while comparing with the likes of Avengers: Infinity War and Star Wars: The Last Jedi in terms of Twitter footprints and sentiment scores. Ticket sales are nearing capacity in many locations on Thursday night, with significant spillover being seen across all Friday shows and into the weekend. There is an eagerness from both die-hard fans and casual Marvel watchers to see this film as soon as possible and avoid what are promised to be massive, franchise-changing spoilers.

From a psychological standpoint, it also helps that Spider-Man and Peter Parker are universally beloved. The character and persona appeal to all demographics as much as any other fictional pop culture icon, as evidenced by the consistent blockbuster performance of the franchise’s films over the past twenty years. That makes No Way Home a generational movie in some aspects, one that demands the big screen experience for friends and families over the holidays — a highly lucrative box office corridor for Hollywood and theater owners, especially for an exclusive cinematic release such as this one.

This weekend is one that’s been circled on the calendar for quite some time during the box office rebound of 2021, which will no doubt extended into 2022 at this point. An army of box office success stories in theaters throughout this year have paved the way and reintroduced the moviegoing experience to those who weren’t able to attend during lockdowns, shutdowns, and certainly before vaccine availability.

No Way Home may be the benefactor of the leg work done by movies such as Godzilla vs. Kong, A Quiet Place Part II, F9, Black Widow, Shang-Chi, Venom: Let There Be Carnage, No Time to Die, Dune, Halloween Kills, Eternals, Ghostbusters: Afterlife, and others — but in its own right, this is the first must-see, communal event film to release since 2019’s Avengers: Endgame and Star Wars: The Rise of Skywalker.

There’s little doubt about pandemic records being set this weekend. The question is how big No Way Home can truly become. From a certain speculative standpoint, it may end up an even bigger phenomenon film *because* of pent-up pandemic demand.

If audiences turn out in the way that seems very possible based on our final projection models, this weekend will be about far more than just pandemic records, but some of the most eye-popping box office numbers of all time.

We’ll see what happens.

Inevitably overshadowed this weekend is also the wide release of Guillermo del Toro’s Nightmare Alley, a star-studded genre pic that’s earning largely positive reviews from critics. Distributed under Disney’s Searchlight Pictures arm, the pic hopes to counter-program the Spidey juggernaut and build out legs over the holiday stretch into New Year’s.

Still, with a 2,145 location count this weekend and minimal screen presence with a very competitive Christmas week coming up, Nightmare faces an uphill battle similar to Edgar Wright’s Last Night in Soho back in October. Tracking, social trends, and pre-sales are similar to that fellow genre film.

Wide Release Forecast Ranges

Nightmare Alley

Opening Weekend Range: $2 – 5 million

Spider-Man: No Way Home

Thursday Preview Range: $44 – 54 million

Opening Day Range (Thursday Previews + Friday): $95 – 130 million

Opening Weekend Range: $190 – $240 million

Weekend Forecast

Boxoffice projects between a 415 to 535 percent increase for this weekend’s top ten films from last weekend’s $40.8 million top ten aggregate.

| Film | Distributor | 3-Day Weekend Forecast | Projected Domestic Total through Sunday, December 19 | Location Count | % Change from Last Wknd |

| Spider-Man: No Way Home | Sony Pictures / Columbia / Marvel Studios | $224,000,000 | $224,000,000 | 4,336 | NEW |

| Encanto | Walt Disney Pictures | $5,800,000 | $80,700,000 | 3,525 | -42% |

| West Side Story (2021) | Disney / 20th Century Studios | $4,800,000 | $19,400,000 | 2,820 | -55% |

| Ghostbusters: Afterlife | Sony Pictures / Columbia | $2,800,000 | $116,800,000 | 3,282 | -61% |

| Nightmare Alley | Disney / Searchlight Pictures | $2,400,000 | $2,400,000 | 2,145 | NEW |

| House of Gucci | United Artists Releasing | $1,500,000 | $44,600,000 | 1,907 | -64% |

| Eternals | Disney / Marvel Studios | $1,400,000 | $163,900,000 | 1,900 | -56% |

| Clifford the Big Red Dog | Paramount Pictures | $550,000 | $48,700,000 | 1,248 | -58% |

| Resident Evil: Welcome to Raccoon City | Sony Pictures / Columbia | $525,000 | $17,100,000 | 719 | -68% |

| Christmas with The Chosen: The Messengers | Fathom Events / Angel Studios | $350,000 | $14,400,000 | ~675 | -72% |

All forecasts are subject to revision before the first confirmation of Thursday previews or Friday estimates from studios or official sources.

Theater counts are updated as confirmed by studios. The above table does not necessarily represent the top ten as some studios do not finalize weekend location counts and/or an intent to report box office returns prior to publishing.

Share this post